Retirement Planning

Retirement should be all about living your dreams: traveling, more time with family or pursuing a passion or hobby.

The goal of MB Investment Services is to ensure you have the financial means to do so.

Whether you need to plan for your personal life or want to help your employees plan for theirs, we can help!

Retirement Planning for Your Life

The best time to start preparing for retirement is now! An individual retirement account, or IRA, can be a tax-efficient way to save and seek to grow your money for your future plans.

MB Investment Services offers both Roth IRAs and Traditional IRAs. Each has their own features and tax structures, so it is important to speak with your tax advisor in preparation for meeting with your representative.

- For many individuals, contributing to an MB Investment Services Roth IRA may result in more retirement income than a comparable investment in a Traditional IRA.

- However, if you aren't eligible for Roth IRA and have some form of income, you can take advantage of the benefits of a Traditional IRA.

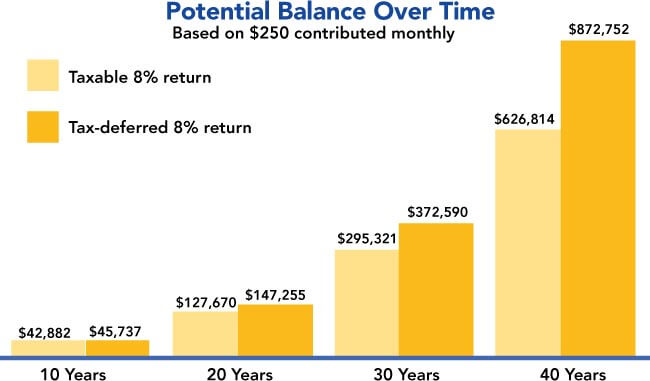

With either type of IRA, you may still come out ahead of a comparable taxable investment because earnings aren't eroded by taxes year after year.

The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax free, as long as they are considered qualified. Limitations and restrictions may apply. Withdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

Contact us to start the conversation!

This hypothetical illustration does not represent the performance of any investment options. It assumes an 8% annual rate of return, a 15% federal income tax bracket and reinvestment of earnings, with no withdrawals. It does not take into account state, local, Social Security or Medicare taxes. Rates of return may vary. Assumes that the taxable account does not hold any investment for more than 12 months. Distributions from a tax-deferred retirement plan are taxable as ordinary income, whereas taxable investments may qualify for lower capital gains rates. The illustration does not reflect any charges, expenses or fees that may be associated with your plan. The tax-deferred accumulation shown above would be reduced if these fees had been deducted.

Establishing a Business Retirement Plan

Aside from helping to attract and retain talented workers, a beneficial business retirement plan may be the right thing to do. MB Investment Services can help you select a suitable plan to assist your employees in funding their own futures.

SEP Plans ( Contribution Limits for 2021 Plans)

- An IRA-based plan fully funded by the employer.

- Contribution per each employee is the lesser of 25% of their annual salary or $58,000.

- SEP plans are discretionary; you can choose not to make contributions if you do not have the funds.

- Contributions are 100% vested immediately.

Simple IRA Plans

- Funded by both employer and employee contributions.

- Employee contributions are made on a pre-tax basis, reducing their taxable incomes.

- Maximum contributions per employee are $13,500, with an additional $3,000 in catch-up contributions available for those age 50 and older.

- All contributions are immediately 100% vested.

Profit Sharing Plans

- Generally discretionary.

- Contribution per employee is the lesser of 100% of salary or $64,500.

- Funding is solely on the employer.

- Vesting schedules are an attractive option to help retain employees.

401(k) Plans

- Usually funded with salary-deferred contributions.

- An employer, you may make matching contributions for each employee who makes a salary-deferred contribution.

- You may also add a profit-sharing feature, which allows you to make discretionary contributions.

- Contribution per employee is the lesser of 100% of salary or $19,500, with $6,500 catch-up contributions for those age 50 and older.

Or contact any MB Investment Services professional

-

Contact Me

Contact MeTom Hart

Financial Consultant

MB Investment Services

Locations: Cortland Office, Garrettsville Office, Middlefield - Main Branch Office, Orwell Office

Phone: (440) 632-3444

-

Contact Me

Contact MeJennifer Pazicni

Financial Consultant

MB Investment Services

Locations: Chardon Office, Middlefield - Main Branch Office, Middlefield - West Branch Office

Phone: (440) 632-8178

-

Contact Me

Contact MeBruce Roby

Financial Consultant

MB Investment Services

Locations: Ada Office, Bellefontaine North Office, Bellefontaine South Office, Dublin Office, Kenton Office, Marysville Office, Plain City Office, Powell Office, Sunbury Office, Westerville Office

Phone: (614) 330-5177

-

Contact Me

Contact MeRic Rotolo

Financial Consultant

MB Investment Services

Locations: Beachwood Office, Garrettsville Office, Mantua Office, Newbury Office, Solon Office, Twinsburg Office

Phone: (216) 359-5526

Check the background of investment professionals associated with this site on FINRA's BrokerCheck ![]() .

.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products offered through LPL Financial or its licensed affiliates. The Middlefield Banking Company and MB Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL Financial offer services using MB Investment Services, and may also be employees of The Middlefield Banking Company. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, The Middlefield Banking Company or MB Investment Services. Securities and insurance offered through LPL or its affiliates are:

Not Insured by FDIC or Any Other Government Agency | Not Bank Guaranteed | Not Bank Deposits or Obligations | May Lose Value |

|---|

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

The Middlefield Banking Company or MB Investment Services (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for brokerage or advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.